maine tax rates for retirees

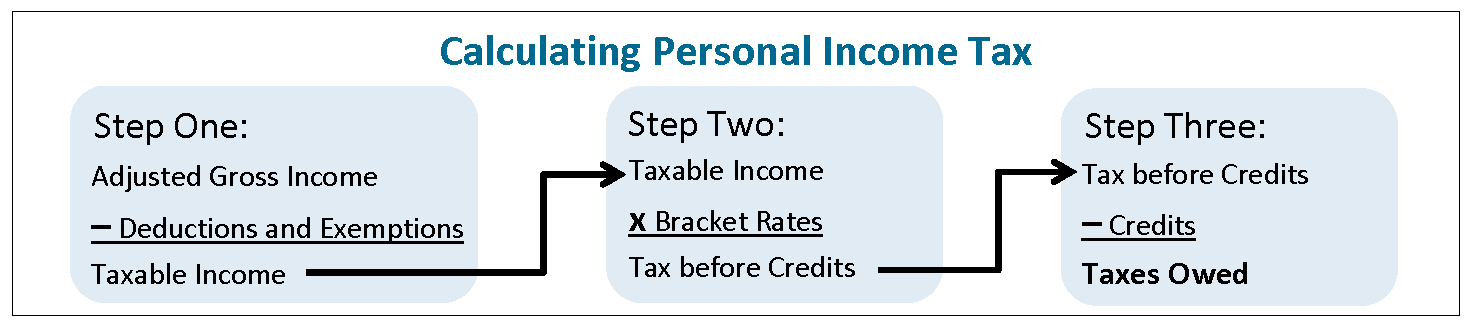

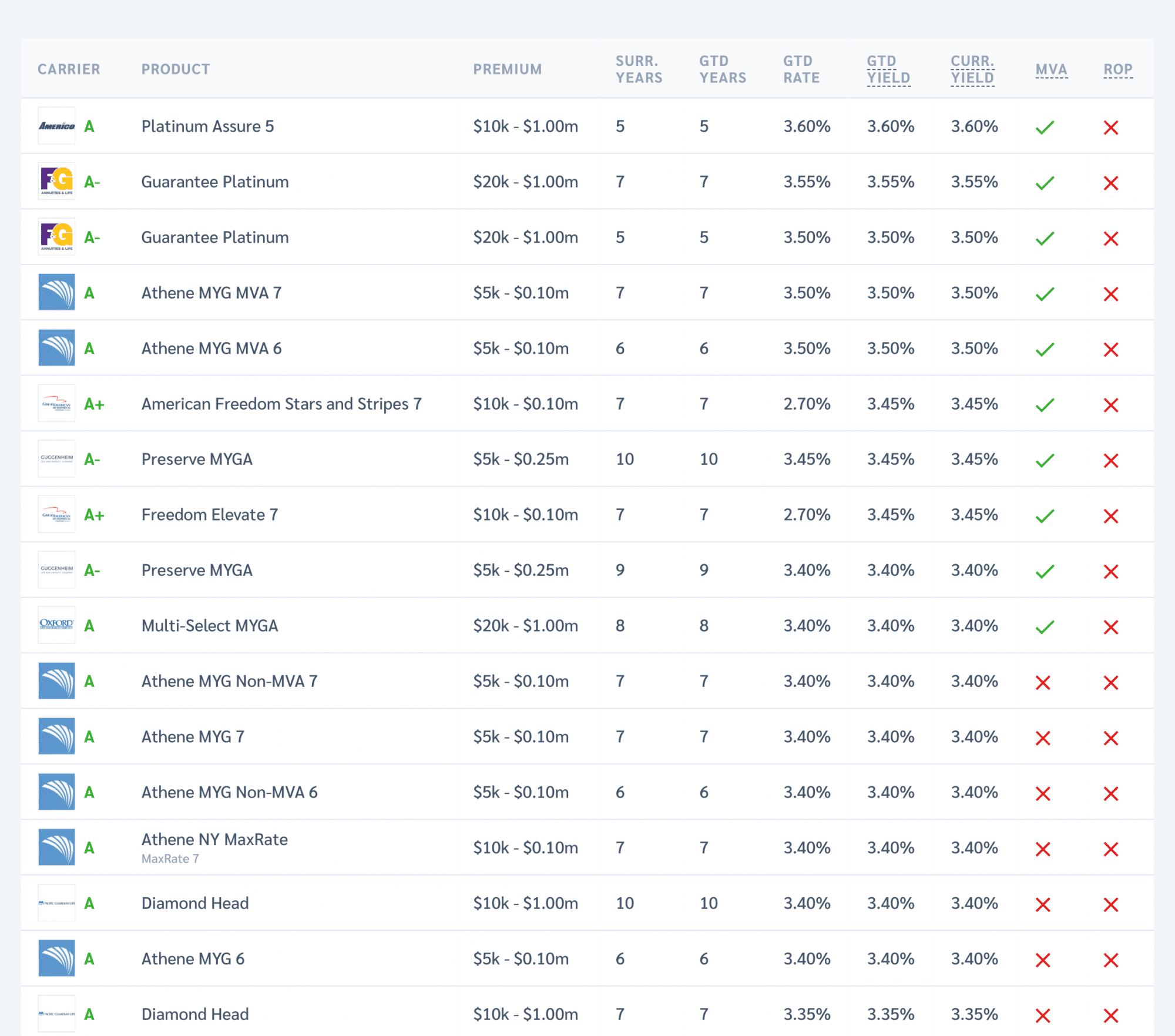

The tax rates range from 58 on the low end to 715 on the high end. This marginal tax rate means.

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

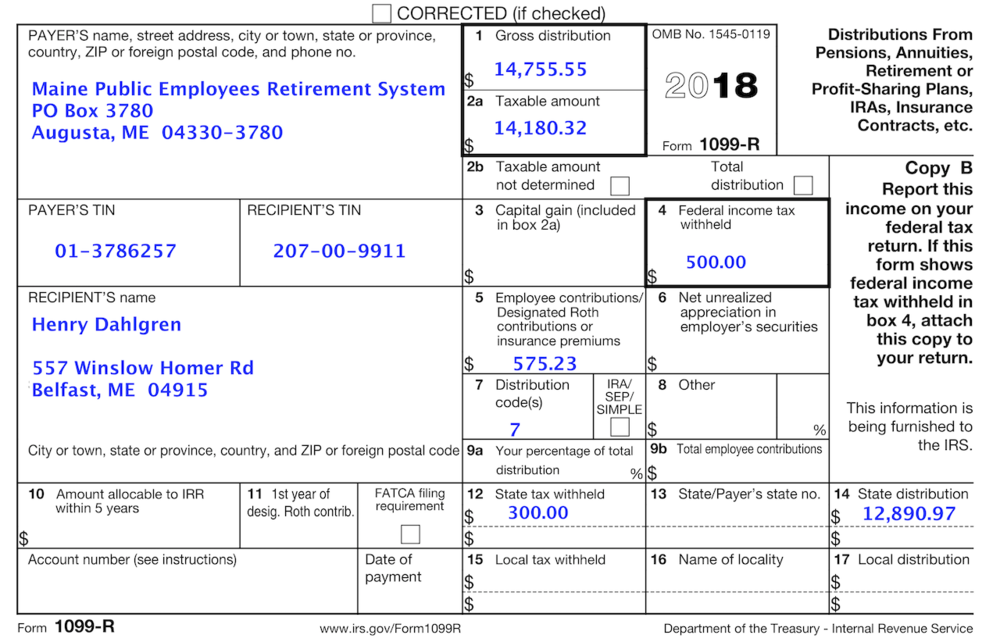

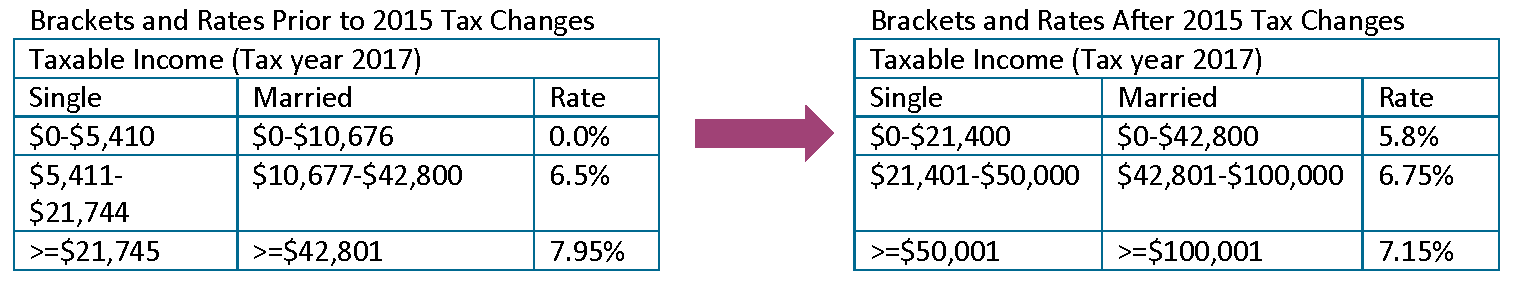

Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns.

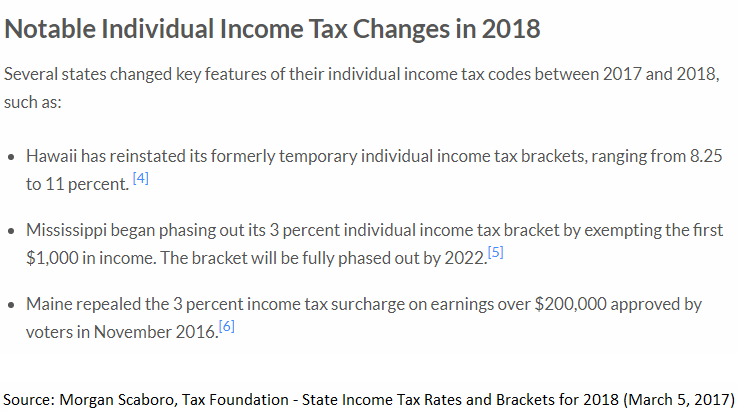

. The rates ranged from 0 to 795 for tax years beginning after. The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015. Your average tax rate is 1198 and your marginal tax rate is 22.

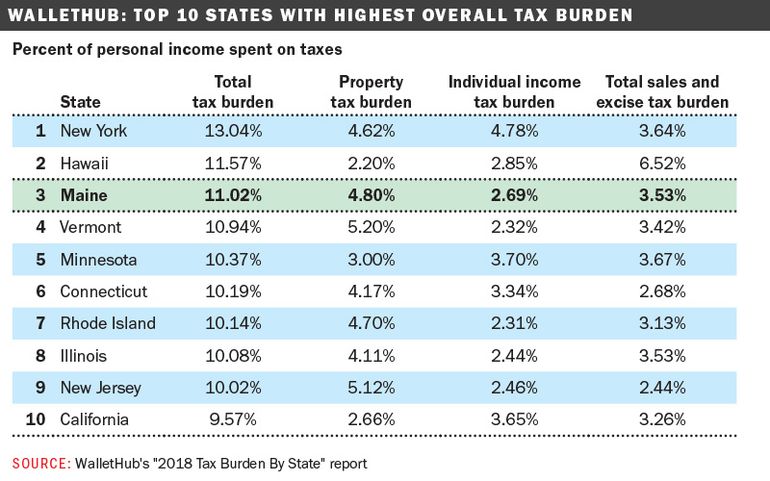

For state income taxes virginia doesnt tax social security. How do I know if Im eligible for the Retired Public Safety Worker. Maine tax rates for retirees Friday August 12 2022 Edit Residents also pay income taxes at a rate of 65 on income between 5200 and 20899 and 795 on income of 20900.

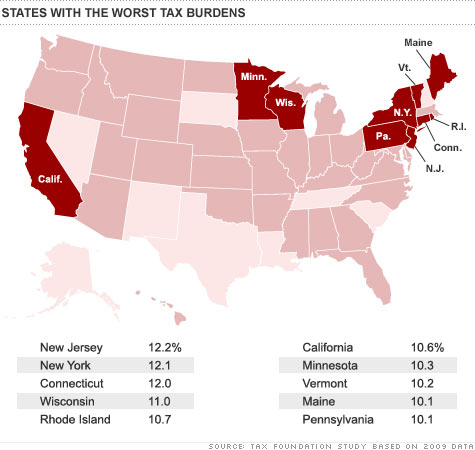

Employer Self Service login Call us toll free. Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. Property taxes are also above average in Maine.

That would add up to taxes of 1200 on that. Single married filing separate. Maines income tax rate ranges from 58 to a top marginal rate of 715.

Permanently exempted groceries from the state sales tax in 2022. For more information please see this document and then contact your tax advisor or Maine Revenue Services. Although the state does not tax Social Security income expect high tax rates of up to 715 on your other forms of retirement incomes.

Kansas and Virginia. Retiree paid Federal taxes on contributions made before January 1 1989. If you make 70000 a year living in the region of Maine USA you will be taxed 12188.

Maine personal income tax rates. Retiree has not paid Federal or State taxes on the interest their contributions earned while they were working. Maines tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living.

The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments.

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

![]()

Opinion A Recent History Of Maine S Swiftly Evolving Tax Code Maine Beacon

Maine Tax Conformity Bill A Step Toward Better Policy Tax Foundation

Map How High Is Your Town S Property Tax Rate Press Herald

Pension Exemptions Benefit Wealthy Households And Compromise Resources Mecep

State And Local Tax Burden Falls To 9 8 Of Income In 2009 Feb 23 2011

How Maine S Personal Income Taxes Work Mecep

Where S My Refund Maine H R Block

Maine State Tax Refund Tax Brackets State Tax Deductions

State Income Tax Data Updated For 2018 Now Available In Total Moneytree Software

Tax Withholding For Pensions And Social Security Sensible Money

15 States That Don T Tax Retirement Income Pensions Social Security

How Maine S Personal Income Taxes Work Mecep

Maine Retirement Tax Friendliness Smartasset

States With The Highest Lowest Tax Rates

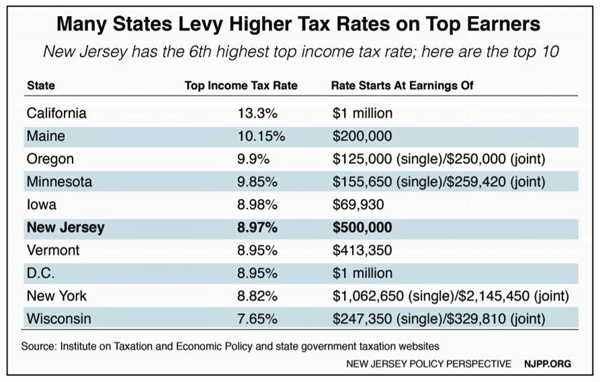

The Provocative Millionaire S Tax Its Potential And Past In N J Whyy

States That Won T Tax Your Federal Retirement Income Government Executive